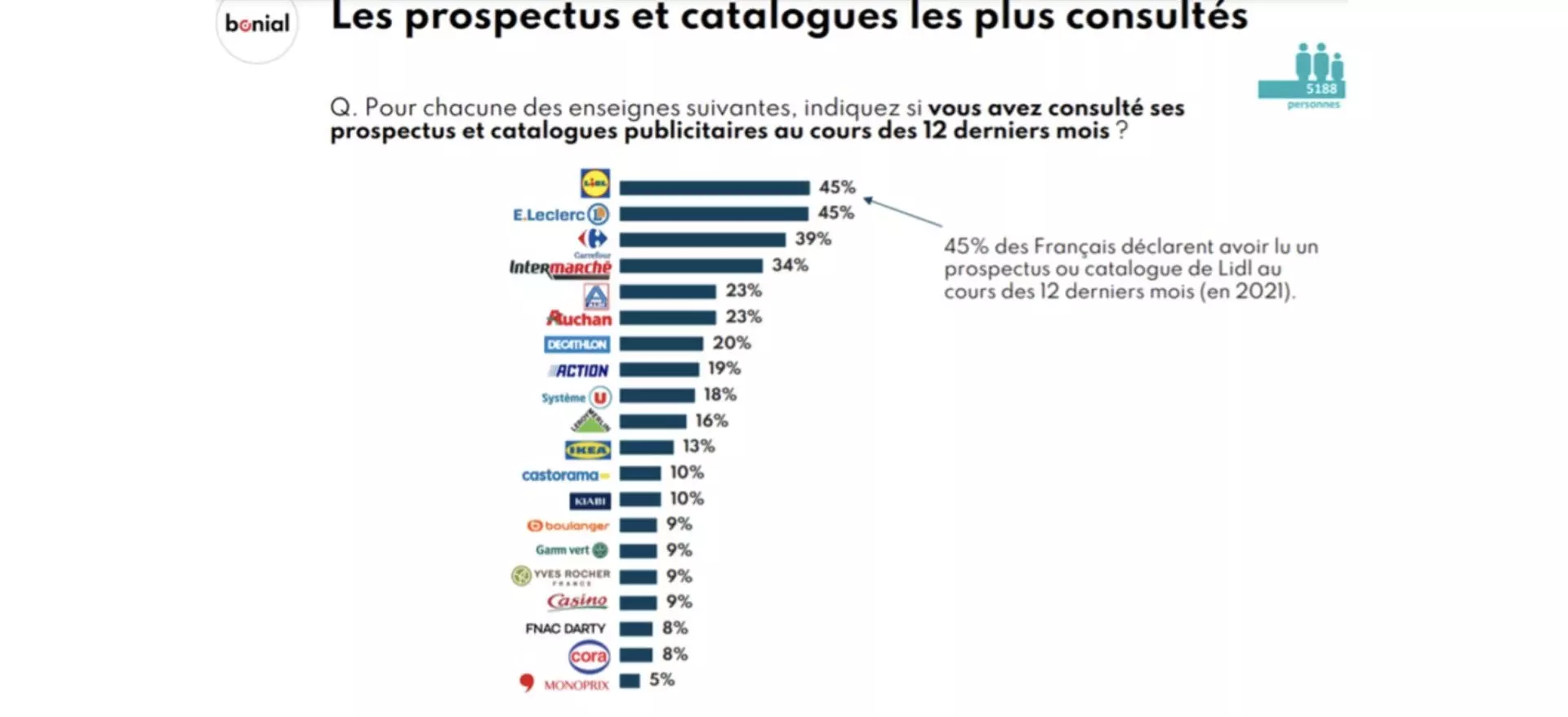

LIDL, the advertising heavyweight, is ready to take advantage!

For LIDL France, a free mailbox is a golden opportunity. No announcements of reduced distribution! In 2021, 1 in 2 French people reportedly read a LIDL catalog.

ALDI, expanding its store network, can’t afford to disconnect from flyers…

“We need them to showcase our Everyday Low Price model and our promotions. Catalog also serves an educational purpose by presenting our range, 90% of which consists of private labels,” notes Anne-Marie Gaultier, Marketing and Communication Director.

CORA outpaces competition in media battle… But at what cost?

Following lockdown, retailer stopped flyer distribution in certain areas to test the impact compared to similar zones and conducted A/B tests on digital campaigns. This involved seven test hypermarkets over a year… Based on this experiment, at the end of 2022, retailer was the first to announce a total halt to mailbox flyer distribution. Time will tell if retailer, without the media power of E.Leclerc or the digital organization of Carrefour, can make a strong enough impact locally to counter its competitors and maintain its traffic.

AUCHAN : a well-underway transition

Auchan is betting on maintaining customer contactability through messaging and local communication. Alcméon and Bonial are supporting this transition with help of store teams to convert customers to digital promotions!

Between March and May 2021, over 1.5 million Auchan flyers were viewed by Bonial’s audience, with an average consultation time of 1 minute and 40 seconds. Retailer is leveraging this engagement to generate more in-store traffic.

According to LSA, 28.5% of catalog and flyer readers visited an Auchan store within seven days of viewing a catalog on Bonial.

CASINO : a timid move toward digital…

Although retailer announced zero-flyer goals, it will take some time before its promotional strategy becomes clear.

MONOPRIX: success in urban areas

As early as 2019, Monoprix announced it would stop flyer distribution for its 30 million units annually. Flyers accounted for 10% to 15% of retailer’s marketing budget, even though 90% of them were discarded before being read… if they even reached mailbox, which is a significant challenge in city centers. Trading area is a crucial factor in success of zero-flyer initiative!